[ad_1]

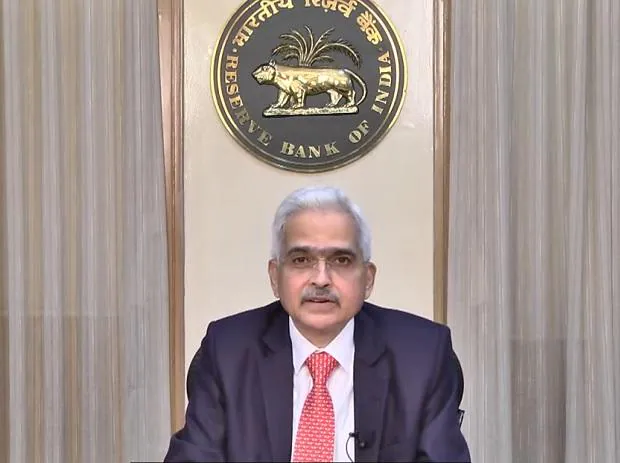

Offline payment aggregators (PAs) who aid in face-to-face transactions at merchant outlets will now come under the regulatory purview of RBI, Governor Shaktikanta Das announced on Friday.

“Keeping in view the similar nature of activities undertaken by online and offline PAs, it is proposed to apply the current regulations to offline PAs as well,” Das said after announcing the bi-monthly policy review.

Das said there will be “convergence on standards of data collection and storage” after the move, meaning that such companies will not be able to store details like those of credit and debit cards of a customer.

The Governor said PAs play an important role in the payments ecosystem and hence were brought under regulations in March 2020 and designated as Payment System Operators (PSOs).

However, the current regulations are applicable only to PAs processing online or e-commerce transactions, he said, adding that they do not cover offline PAs who handle proximity/face-to-face transactions and play a significant role in the spread of digital payments.

Meanwhile, Das also announced that the criteria for regional rural banks (RRBs) to be eligible to provide internet banking to their customers are being rationalised.

The RRBs are currently allowed to provide Internet Banking facility to their customers with prior approval of the Reserve Bank, subject to fulfilment of certain financial and non-financial criteria, he said.

Das said the decision has been taken keeping in view the need to promote the spread of digital banking in rural areas and added that guidelines will be issued on the same soon.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

[ad_2]

Source link