[ad_1]

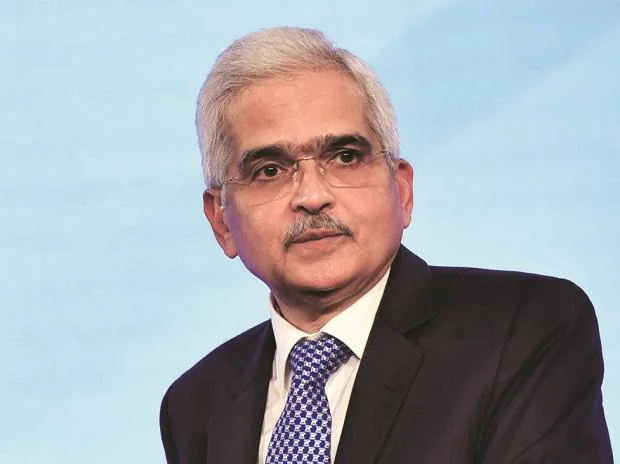

Reserve Bank of India Governor Shaktikanta Das said around 67 per cent of the decline in foreign exchange reserves during the current fiscal year were because of valuation changes owing to a stronger US dollar and higher US bond yields.

“How we stand compared to other emerging market economies and other countries, and almost in all parameters, our vulnerabilities are far less than most of the other emerging market economies. I also mentioned this point to dispel any public notion,” Das said at a post-monetary policy press conference.

His comments come in the wake of the finance ministry signaling earlier this week that the government was not in favour of selling the US dollar to defend any particular level of the rupee.

From an all-time high of $642.45 billion as on September 3, 2021, the RBI’s foreign exchange reserves have declined to a two-year low of $537.52 billion as on September 23, 2022, the latest data showed. The headline reserves have declined $94 billion from $631.53 billion in late February, when Russia invaded Ukraine. The RBI said earlier this month that $553 billion worth of reserves represented an import cover of nine months for the current fiscal year. The import cover was for 15 months in September 2021.

Pointing out that India had witnessed an accretion of $4.6 billion in foreign exchange reserves on a balance of payments basis in April-June, Das said that the current level of reserves represented strong buffers taking into account external sector vulnerabilities.

So far in the calendar year, the rupee has depreciated 8.6 per cent versus the dollar. The pace of the rupee’s depreciation, however, has been aggravated since September 21. which was when the Federal Reserve signaled a longer-than-expected US rate hike cycle. The domestic currency has shed 1.7 per cent since then.

Das reiterated on Friday the RBI does not target any particular level for the domestic exchange rate and only intervenes in the market to smoothen out excessive volatility.

“India’s other external indicators, viz., external debt to GDP ratio; net international investment position to GDP ratio; ratio of short-term debt to reserves; and debt service ratio also indicate lower vulnerability as compared with most other major EMEs,” Das said on Friday.

At the end of June 2022, India’s external debt was at $617.1 billion, showing a decrease of $2.5 billion over its level at the end of March 2022.The external debt to GDP ratio declined to 19.4 per cent at end-June 2022 from 19.9 per cent at end-March 2022, the RBI said.

Short-term debt on residual maturity basis constituted 45.4 per cent of total external debt at the end of June 2022 versus 43.2 per cent at the end of March and accounted for 47.6 per cent of foreign exchange reserves. Short-term debt is that which matures in a year.

“The RBI emphasised that their strategy would be focused on maintaining investor confidence and anchoring expectations — signaling that FX interventions are likely to continue and be focussed towards defending any extreme volatility in the rupee,” HDFC Bank’s Treasury Economics Research team wrote.

“The absence of any additional measures in order to shore up reserves and attract capital (like was done in 2013) signals RBI’s comfort with the current level of foreign exchange reserves as well as the level of the rupee. Given the continued dollar rally and elevated global risks, the USD/INR pair is likely to witness continued depreciation pressures and we expect a range of 81-82 in the near-term,” they wrote.

[ad_2]

Source link