[ad_1]

Tamilnad Mercantile Bank (TMB) has said it will continue its focus on the retail, agriculture and MSME (RAM) segments, retaining them for 80-85 per cent of its total loan portfolio.

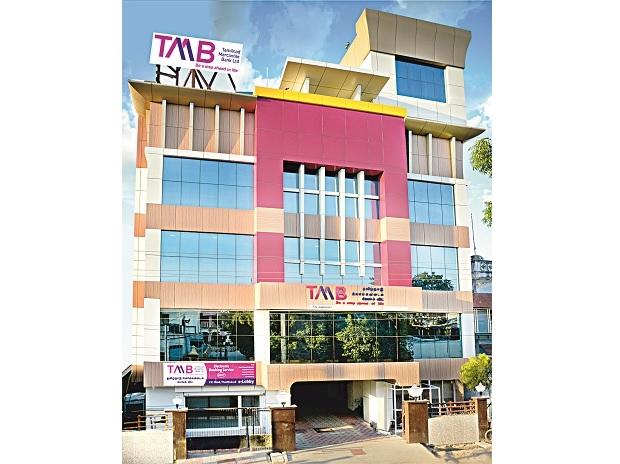

The Thoothukudi-based bank will open 25 new branches by March this year, after the Reserve Bank of India (RBI) lifted its three-year ban in October last year.

TMB is one of India’s oldest private sector banks, established over 100 years ago in 1921 as Nadar Bank and catering to micro, small and medium enterprises (MSME), agricultural and retail customers. In the third quarter of the current financial year, the share of RAM in its portfolio was 89 per cent, up from 87 per cent in the July to September period.

“RAM segment always has a multiple advantage, as my risk is diversified. This bank, for 100 years, is well tuned with MSMEs and its trading. We understand the nuances of MSMEs very well and MSME units also understand the bank,” said S Krishnan, managing director and chief executive officer of the bank.

“Going forward also, it may be the same as in the range of 80-85 per cent. We will also take up the corporate segment. But the focus will continue to be on RAM,” he said.

The bank has 511 branches, of which two started after an initial public offering and the RBI lifting its ban. The reason for the ban dates back to 2016 when TMB shareholders decided to raise its authorized share capital to Rs 500 crore. The RBI imposed several restrictions in June 2019, citing that TMB did not raise its subscribed capital to at least half of the authorized capital as required. Some restrictions were lifted in March 2021, but the one on branch expansion continued till October 2022.

“We got the RBI approval by the end of the last quarter. Immediately after that, we started two more branches and now the plan is to add 25 more branches across the country by the end of March. Very shortly, we will have our first footprint in North East India too,” Krishnan said.

TMB is also working on expansion plans for the next financial year and will approach its board with a roadmap. Krishnan said the bank is focused on phygital mode—services combining physical and digital features—and it will soon launch tablet banking facility for customers. It will also rolling out the second phase of mobile banking by the first week of February. The bank will come up with branches wherever there is potential business.

In the third quarter of this financial year, TMB posted a 38 per cent rise in net profit to Rs 280 crore, as compared to Rs 203 crore during the October to December quarter last year. “If you look at growth, there were multiple parameters that led to it. One of the drivers for this growth is NIM, which is one of the best in the industry. Added to that, I have been able to contain the slippages, and also make recovery, this has resulted in a very low credit cost,” said Krishnan.

[ad_2]

Source link