[ad_1]

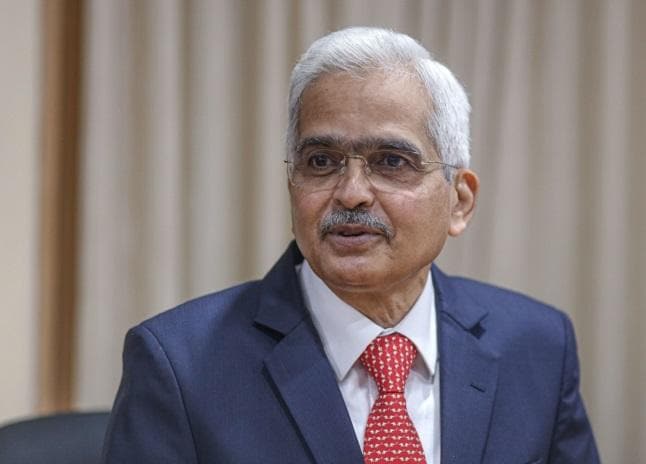

Reserve Bank Governor Shaktikanta Das will hold a meeting with CEOs of public sector banks on Wednesday to discuss issues concerning slow deposit growth and sustainability of high credit demand.

As per the Reserve Bank of India (RBI) data, deposits rose by 9.6 per cent as compared to 10.2 per cent on a year-on-year basis, while credit offtake witnessed a jump of 17.9 per cent as against 6.5 per cent a year ago.

According to an agenda circulated for the meeting, sources said, sustainability, including pricing and slow growth of deposits, would be discussed.

There would be deliberation on asset quality in the retail and MSME segment, sources said.

Besides, the meeting would also review the functioning of Digital Banking Units launched by Prime Minister Narendra Modi last month.

The robust growth performance in the first half of the current fiscal has been ably supported by a well-capitalised banking system that witnessed an upswing in credit disbursement to the retail, industry and services segments.

Non-food credit growth almost doubled from 8.7 per cent in March 2022 to 16.4 per cent in September 2022, reflecting not only an acceleration in the growth of current economic activities but also an anticipation of continued acceleration in the future as well.

The growth in credit to industries has been driven by an increase in bank credit to MSMEs aided by the ECLG scheme.

In August, the Union Cabinet approved an additional Rs 50,000 crore under the Emergency Credit Line Guarantee Scheme (ECLGS) to ensure low-cost credit flow to hospitality and related segments hit hard by the COVID-19 pandemic.

The limit for ECLGS increased from Rs 4.5 lakh crore to Rs 5 lakh crore, with the additional amount being earmarked exclusively for enterprises in hospitality and related sectors.

The enhancement is expected to provide much-needed relief to enterprises in these sectors by incentivizing lending institutions to provide an additional credit of up to Rs 50,000 crore at low cost.

The ECLGS was announced in May 2020 in wake of the outbreak of COVID-19 to help various sectors, especially in the MSME segment, to get credit at a concessional rate of 7 per cent. Loans of about Rs 3.67 lakh crore have been sanctioned under ECLGS till August 5, 2022.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

[ad_2]

Source link