[ad_1]

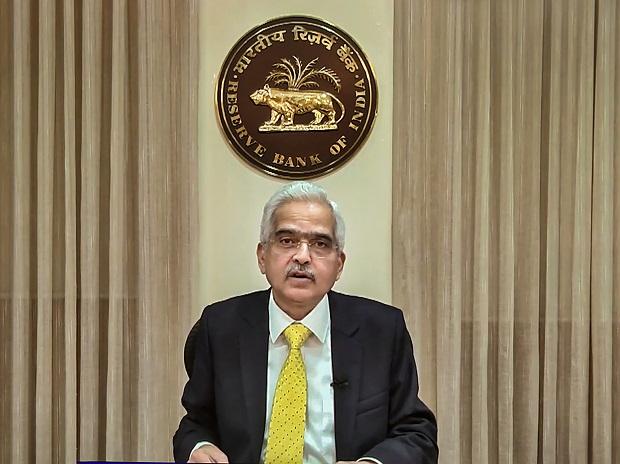

The Reserve Bank of India’s Monetary Policy Committee (MPC) on Wednesday raised the repo rate by 25 basis points to 6.50 per cent in order to bring inflation back towards the central bank’s 4 per cent target. The RBI management, including Governor Shaktikanta Das and Deputy Governors Michael Patra, M K Jain, M Rajeshwar Rao and T Rabi Sankar, spoke to the media about various issues after the rate hike.

Here are edited excerpts from the interaction.

Q: What is the reason behind forecasting inflation at 5.6 per cent in Q4FY24?

Patra: The average inflation is expected to be lower in 2023-24 than in 2022-23. The forecast for H2FY24 is high because of the base effect of this year.

Das: The MPC decision is a majority decision. In the current tightening cycle, especially with regard to rates, we have refrained from giving forward guidance. Because it may become counterproductive. We have said that we will be extremely watchful of the incoming data as well as the outlook on inflation, and what is happening in the overall economy.

How long can banks continue to have a large gap between credit and deposit growth?

Patra: The difference has narrowed but there is still a difference and it is really up to the banks to mobilise deposits and make up the gap. They are doing so through certificate of deposits and reducing their non-SLR investments but they need to mobilise deposits on their own to meet the gap.

Jain: There is an increase in the deposit side also. The credit deposit (CD) ratio for the banking sector has increased a little bit but the liquidity coverage ratio is at a comfortable level, much higher than the regulatory requirement.

What will guide your decision to pause?

Patra: We have nudged the real rate into positive territory. Its level will be decided by the evolving macroeconomic configurations. So, it is not necessarily guided by pre-pandemic levels, but by the evolving growth and inflation trajectory.

Is 6.4 per cent GDP growth for FY24 an achievable target, given the external risks?

Patra: We recognise that the global situation may result in the next exports becoming a drag in our growth. And, therefore, in 2023-24 relative to 2022-23, there is a deceleration from 7 per cent to 6.4 per cent. As of now, given the current projections of world trade and world output by international agencies, it is achievable.

Are you looking at some level of liquidity before it starts normalising?

Das: In the beginning of this financial year, liquidity was around Rs 7-8 trillion. Now, the average daily Liquidity Adjustment Facility (LAF) is around Rs 1.6 trillion. During this period, on two occasions, we undertook variable rate repo operations for short periods when there was some stress in the liquidity situation. The Liquidity Coverage Ratio (LCR) of the banks is quite a bit more than what the norms prescribe. So, they have that much more liquidity to support their lending. And the CD ratios are at reasonable levels. So, there is a lot of capacity with the banks to continue with their lending operations. It’s difficult for me to give out a number and it will depend on the evolving situation. But we will be responsive to the needs of the productive sectors of the economy so far as liquidity is concerned.

Is core inflation holding you back on any indication of pause in the future?

Das: At this point of time, a 25 basis point hike was considered appropriate, taking into account the mix of factors. Since we have moderated the pace of hikes, this gives us room to assess the impact of actions undertaken so far. So, we will continue to assess that and take an appropriate call, going forward.

Will you be able to manage the government’s record borrowing programme effectively?

Rabi Sankar: The market borrowing last year was considered high but it was managed smoothly and it will be managed smoothly this year also. We are jumping the gun talking about OMOs (Open Market Operations) at this point of time. There is adequate demand, markets are deep enough. So, we are fairly confident that there would not be any problem in mobilising government borrowing this year.

Das: The net borrowing last year was Rs 11.08 trillion and this year it is Rs 11.80 trillion on an expanded nominal GDP base.

Why is core inflation sticky? As long as it is, will RBI continue with tighter monetary policy?

Patra: Core inflation is associated with excess demand which is why monetary policy acts to bring down core inflation and that is why we have been bringing down rates. So, we expect our rate actions as they pass through into the economy to modulate demand and modulate core inflation.

What is the preparedness of banks for expected credit loss (ECL) framework?

Rao: It is generally assumed that the ECL norms would be higher than the current approach. But that may not be necessarily true in all cases. If you look at the position of the banks, they are well prepared to absorb it. The PCR ratio has improved to 71.5 per cent as of September 2022. The discussion paper has been placed in public domain and we are expecting the comments to come in by February end. Shortly thereafter, we will issue the final guidelines, taking into consideration the feedback being received.

[ad_2]

Source link