[ad_1]

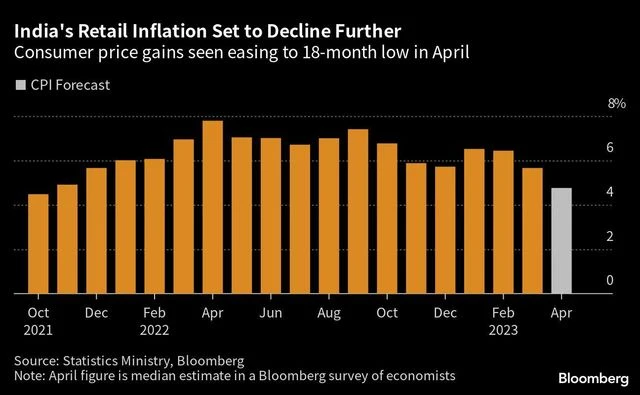

Consumer prices in India are showing further signs of moderation, giving the central bank room to keep rates on hold after an aggressive tightening campaign dampened demand and muddled the wider outlook for the economy.

Easing inflation will bring relief to policy makers when the economy is facing headwinds from geopolitical tensions and slowing global demand. With higher borrowing costs weighing on India’s world-beating growth, the central bank put the brakes on its tightening cycle in April, while leaving the door open for maneuvering until the “war against inflation” is over.

)

Policy Pivot

The decline in inflation is expected to help the central bank’s six-member Monetary Policy Committee leave the benchmark rate unchanged for the second time when it meets on June 6-8. While Governor Shaktikanta Das described the MPC’s April decision as a “pause, not a pivot,” his deputy Michael Patra has said he sees the economy transitioning into a “low inflation regime.”

“Disinflation of this magnitude in two successive months should put to rest any concerns about inflation and allow the central bank to extend its rate hold at its June review.”

The RBI’s pause is in line with the pivot by global central banks. The US Federal Reserve lifted interest rates by a quarter point last week and hinted it could be the last increase for now. The impact is reflecting in India’s debt markets, with the benchmark 10-year yields hovering around 7% — the lowest level in more than a year.

)

Containing price pressures is equally important for Prime Minister Narendra Modi whose ruling party is fighting hard to retain power in a key state this week and ahead of national elections next year where the leader will seek a third term. Inflation has been a hotly-debated campaign issue in recent local ballots and is a key worry for voters.

While the government has boosted imports of certain items such as edible oils to rein in inflation, it’s falling global commodity prices that have primarily contributed to slower price gains, with wholesale prices falling 0.30% in April from a year ago, according to a Bloomberg survey as of May 11. The gap between the two gauges is widening as manufacturers refrain from fully passing on the fall in input costs to end-consumers to protect margins.

Want to get the latest business news and analysis from Bloomberg on Telegram? Join our channel by clicking here and tapping Join.

[ad_2]

Source link