[ad_1]

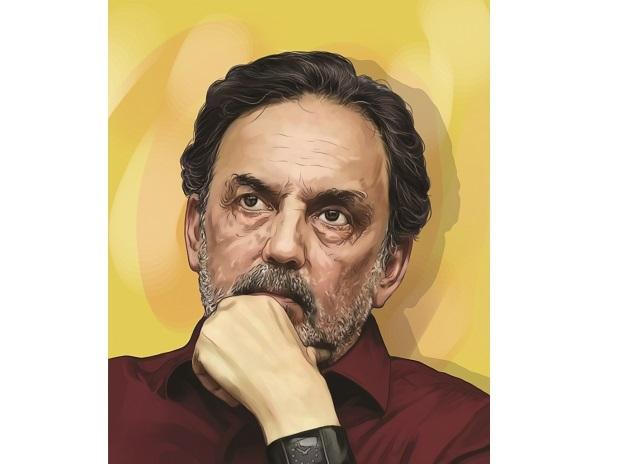

New Delhi Television (NDTV) on Tuesday night disclosed to the stock exchanges that its promoters, Radhika Roy and Prannoy Roy, had stepped down as directors from the board of RRPR Holding, an NDTV promoter entity. At the same time, the board of RRPR Holding had approved the appointment of three people, Sudipta Bhattacharya, Senthil Chengalvarayan and Sanjay Pugalia, as directors, NDTV said.

The development was crucial and came a day after Radhika Roy Prannoy Roy (RRPR) Holding had transferred shares constituting 99.5 per cent of its equity capital to Vishvapradhan Commercial Pvt Ltd (VCPL), which is owned by the Adani group. Bhattacharya, Chengalvarayan and Pugalia were the Adani group’s nominees on RRPR Holding’s board.

Their appointment marks the end of Round One of the acquisition plans of the news broadcaster unveiled by the Adani group in August. RRPR Holding has a 29.18 per cent stake in NDTV. Prannoy and Radhika Roy individually own 15.94 per cent and 16.32 per cent stake, respectively, in the company.

Round Two, which includes the ongoing open offer for an additional 26 per cent stake in the media company, will conclude next week.

So, what triggered the change of hands at RRPR Holding? And what potential lies ahead for the media company?

From August to now: What happened?

On August 23, AMG Media Networks, a wholly-owned subsidiary of Adani Enterprises, acquired a 100 per cent stake in VCPL.

VCPL owned convertible debentures (in the form of warrants) in RRPR Holding, which in turn owned 29.18 per cent stake in NDTV. So, with the VCPL purchase, the Adani Group would indirectly acquire a 29.18 per cent stake in NDTV upon conversion of warrants in RRPR Holding into equity shares.

The same day, VCPL notified RRPR Holding of its intention to convert these warrants (issued in 2009) into equity shares, giving the firm 99.5 per cent control of the company. This would, VCPL said, trigger a mandatory open offer for an additional 26 per cent stake.

However, the Roys, who are the founder-promoters of NDTV, indicated the same day that the exercise of rights by VCPL was executed without any input from, conversation with them, or their consent to it.

The Roys also subsequently said that the transfer of RRPR shares to VCPL, which would give the Adani group a 29.18 per cent stake in NDTV, could not go ahead without a nod from the Securities and Exchange Board of India (Sebi), since the founder-promoters were restrained from the securities market for two years. That period would end on November 26, they said.

But the Adani group reiterated its commitment to the open offer, first indicating a tentative timeline of October 17 to November 1 for the issue. This was then pushed to November 22, following Sebi’s approval to the open offer. The open offer of nearly Rs 493 crore concludes on December 5.

So far, exchange data shows that Adani’s open offer has seen 5.3 million shares being tendered by shareholders, which represents 31.78 per cent of the 16.7 million shares on offer in the issue.

While a clearer picture of who tendered these shares will emerge on the final day of the offer, NDTV shares were locked at the 5 per cent upper circuit for the fourth straight session on Wednesday (November 30), at Rs 447.70 apiece on the BSE (till the filing of this report). This is at a 52.27 per cent premium to the open offer price of Rs 294 a share.

[ad_2]

Source link