[ad_1]

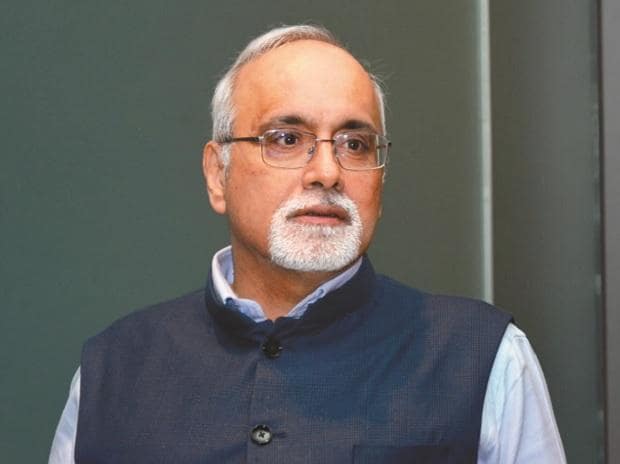

“Boards should appraise the performance of management objectively and ensure that they are held accountable for their actions. If the management is not meeting expectations, boards should take suitable action, including replacing the management, to improve the bank’s governance and risk management,” Rao said in his speech at the conference of the directors of banks. The RBI had organised the conference for public sector banks on May 22 in New Delhi and private sector banks on May 29 in Mumbai.

Rao said the boards of banks should set clear expectations for the management in terms of risk management and corporate governance. He added that the management should be required to regularly report risk management. “This reporting should include information on the bank’s risk appetite, risk exposures, and risk mitigation strategies,” he said.

He said boards must ensure a suitable policy framework to assess effectiveness, in accordance with their strategies and risk profiles. The effectiveness must be tracked at all levels – individual director, committee, and the overall board.

According to Rao, there are two key challenges in ensuring sound corporate governance in banks.

“First, the banks are placed at a higher pedestal vis-à-vis other financial or non-financial entities due to their unique role,” he said. “Second, the most important stakeholder for the bank, i.e. depositors, tend to be diversified, diffused, and passive.” He added that this is a challenge the board of directors have to address to ensure that the management’s incentives are aligned with the interest of depositors and other stakeholders.

[ad_2]

Source link