[ad_1]

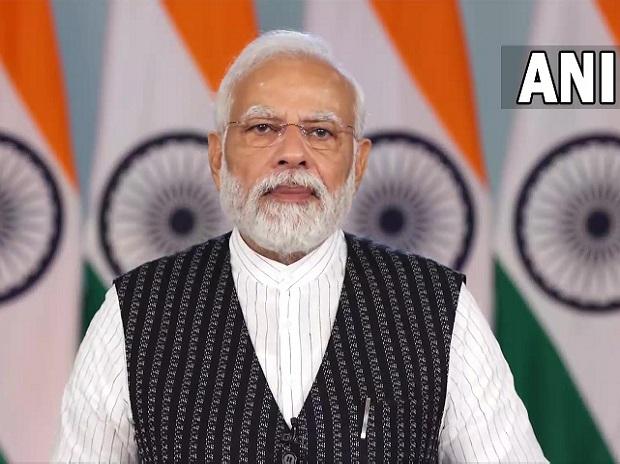

Prime Minister Narendra Modi on Sunday said the 75 digital banking units (DBUs) in 75 districts is a big step towards ‘ease of living’ for common citizens and will open up a whole new world of possibilities by combining financial partnerships with digital partnerships.

Inaugurating the 75 DBUs virtually, Modi said the special banking system shall work to provide maximum services from minimum digital infrastructure. “It will also simplify the banking procedure while providing a robust and secure banking system. In a village, in a small town, when a person takes the services of a digital banking unit, everything from sending money to taking loans will become easy, online,” he added.

In her FY23 Budget speech, Finance Minister Nirmala Sitharaman announced that 75 DBUs would be set up to ensure that the benefits of digital banking reach every nook and corner of the country in the 75th year of Independence.

As many as 11 public sector banks, 12 private sector banks, and one small finance bank have established brick-and-mortar DBU outlets across the country that will operate round the clock. DBUs will provide a variety of digital banking facilities to people, such as opening savings accounts through eKYC/video KYC, balance-check, printing passbooks, transfer of funds, investment in fixed deposits, loan applications, stop-payment instructions for cheques issued, applying for credit/debit cards, viewing statement of account, paying taxes, paying bills, and making nominations.

The DBUs will help banks that are now looking to reduce their physical footprint with fewer brick-and-mortar branches, with a ‘light’ banking approach. The move may open up the rural market for service providers, besides providing a boost to credit flow.

Participating in the event from the US, Sitharaman said DBUs will go a long way in giving further impetus to digital banking in India and help the economy to move towards a cashless and inclusive economy. “DBUs will enable people who don’t have a personal computer, laptop, or even a smartphone to be able to access banking services. The government’s credit-linked schemes through the Jan Samarth portal will also be available for ordinary users,” she added.

State Bank of India, the country’s largest lender, has opened 12 of the 75 DBUs, in places like Port Blair in Andaman & Nicobar Islands, Balod in Chhattisgarh, and East, North and West Sikkim, among others. Bank of Baroda has opened 8 DBUs, which are in Varanasi, Kota, Vadodara, among others.

HDFC Bank – the country’s largest private sector bank — has opened 4 DBUs in Haridwar, Chandigarh, Faridabad (Haryana), and South 24 Parganas (WB). ICICI Bank – the second largest private sector bank has also opened 4 DBUs, in Dehradun, Karur (TN), Kohima, and Puducherry.

[ad_2]

Source link