[ad_1]

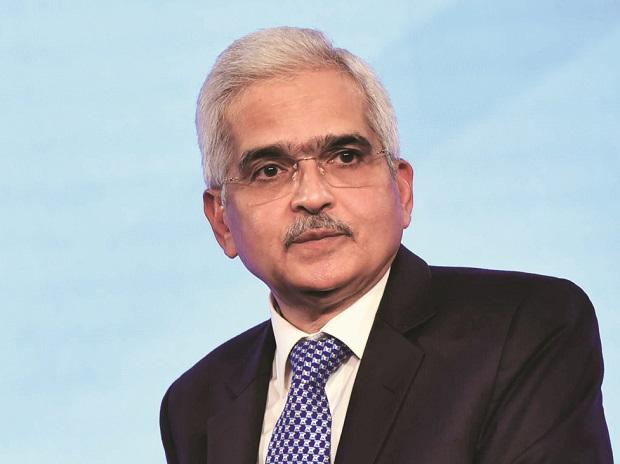

After a pandemic-induced hiatus of two years, Business Standard BFSI Insight Summit is back in a physical form, featuring some of the leading voices of the country’s financial sector. The summit will kick off on Wednesday with a keynote fireside chat with Reserve Bank of India (RBI) Governor Shaktikanta Das, and expo inauguration by former Sebi chairman M Damodaran.

Across December 21 and 22, the summit will see 11 panel discussions on a range of topics impacting various sectors of India’s financial system.

The RBI governor is set to share his views at a time inflation has fallen below 6 per cent, and thereby within RBI’s tolerance limit of 2–6 per cent, for the first time this calendar year. But the governor has reiterated on many occasions that the battle against inflation is far from over. So, the central bank has remained on guard to see a durable decline in inflation. The six-member monetary policy committee (MPC) headed by the governor has raised the benchmark policy rate by 225 basis points since May to tame inflation and bring it within the tolerance band, resulting in the interest rate on loans rising for consumers. On the other hand, savers are breathing a sigh of relief as their bank deposits are attracting higher interest rates after a long period.

The governor’s views hold significance as borrowers and experts are anxious over the RBI’s probable future rate hikes before a pause. The repo rate currently stands at 6.25 per cent.

Other prominent speakers at the summit include RBI deputy governors T Rabi Sankar and M Rajeshwar Rao, Irdai member Rakesh Joshi, Sebi whole-time member Ashwani Bhatia, One97 Communications Chairman and CEO Vijay Shekhar Sharma, and GQuant Founder Shankar Sharma, among others.

The panel discussions will see the top honchos of banking, insurance, and NBFC sector give their views on key topics of current times.

The movers and shakers of the banking industry, including chiefs of leading lenders such as State Bank of India’s Dinesh Kumar Khara, Bank of Baroda’s Sanjiv Chadha, Punjab National Bank’s Atul Kumar Goel, Axis Bank’s Amitabh Chaudhry, and Ashu Khullar of Citi India, among others, would share their views on furthering growth in the Indian economy and how banking sector can play a pivotal role in that.

At a time when the non-banking finance space is going through a period of consolidation, with many large entities going belly up after the IL&FS crisis, and HDFC merging into HDFC Bank, the brass of some of the largest NBFCs will give their views on whether they are harbouring ambitions of turning into a bank, given the RBI has almost eliminated the regulatory arbitrage that existed between banks and NBFCs.

The two-day event will also see discussions on how players operating in the payments space can make money or build a viable business model, with Dilip Asbe, MD & CEO of NPCI, which operates and manages Unified Payments Interface (UPI), sharing his views on the subject.

There will be discussions about the new banks on the block, small finance banks, and whether they can make it big. Some of the top economists will debate if India is decoupled from developed economies, and which is most likely to experience recession.

Top bosses of insurance companies will share their views on how insurance penetration can be improved further, especially at a time when the insurance regulator has been actively looking to bring in ease of doing business in the sector so that companies can realise their full potential and use their resources better to insure a large part of the country.

CEOs of mutual fund houses will brainstorm on how to traverse the journey from India to Bharat, while their CIOs give opinions on where to invest in this market.

[ad_2]

Source link