[ad_1]

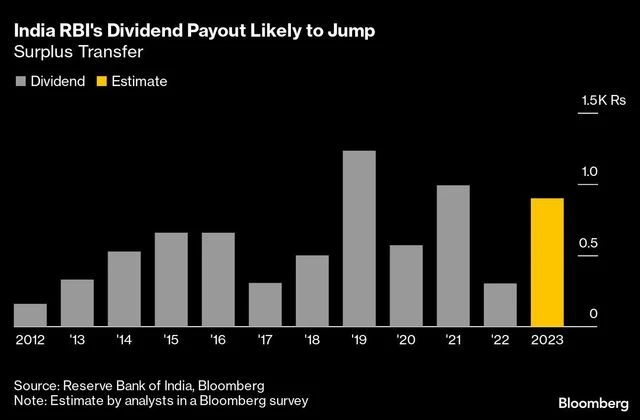

The Reserve Bank of India board may decide to nearly double its dividend to the government from official estimates due to revaluation gains and profits from selling dollars, which could help bridge the fiscal deficit.

The RBI board is set to meet on Friday as early signs of slowing growth emerge with elevated interest rates and falling global demand. A higher dividend payout will help Prime Minister Narendra Modi’s government to meet its target of lowering the fiscal deficit to 5.9% of gross domestic product in the current fiscal year from 6.4% a year ago and shore up revenues ahead of the 2024 national vote.

)

“Gains from the near record gross foreign exchange sales in fiscal year 2022-23 would be the major driver of higher surplus,” said Madhavi Arora, economist at Emkay Global Financial Services. The dividend could bring in additional revenue of 0.2% of GDP, which could partly offset losses in bonds and cover for lower tax revenue and slower divestment, she said.

Economists polled by Bloomberg expect the dividend to range between 525 billion rupees to 1.65 trillion rupees. The highest estimate surpasses the central bank’s record 1.23 trillion dividend transfer for the year 2018-19.

The RBI probably acquired the greenback at around 62.7 rupees per dollar in the last fiscal year, and sold it around 81-82 rupee level, earning as much as 690 billion rupees from foreign exchange transactions, according to Gaura Sen Gupta, an economist at IDFC First Bank.

The RBI’s balance sheet probably expanded about 2% in the last fiscal year, the slowest since 2016-17’s demonetization exercise, and compares with 9% expansion a year before, according to Arora, as abundant liquidity in the system limited the need for bond purchases from the markets.

“Given there is no buffer left in the interest rate revaluation account for foreign securities, this loss will need to be charged directly to contingency reserves that is part of RBI realized equity,” Upadhyay said.

“The moot point would be to gauge whether RBI draws comfort from distributing higher dividend purely out of revaluation reserves owing to rupee weakness or shows prudence at a time when in reality foreign exchange reserve kitty has declined over the year,” said Siddharth Kothari, an economist with Sunidhi Consultancy Services.

[ad_2]

Source link