[ad_1]

“This can reduce the cost of such offerings and help in development of unique products for Indian markets,” said RBI in its Statement on Developmental and Regulatory Policies.

After being linked with UPI, the sanctioned limit on a RuPay credit card can be used to make payments to a merchant who pays a charge for accepting such payments. The facility expanded the scope of payments with credit as a source and the RBI’s latest announcement will strengthen the UPI network being used to facilitate payments financed by credit.

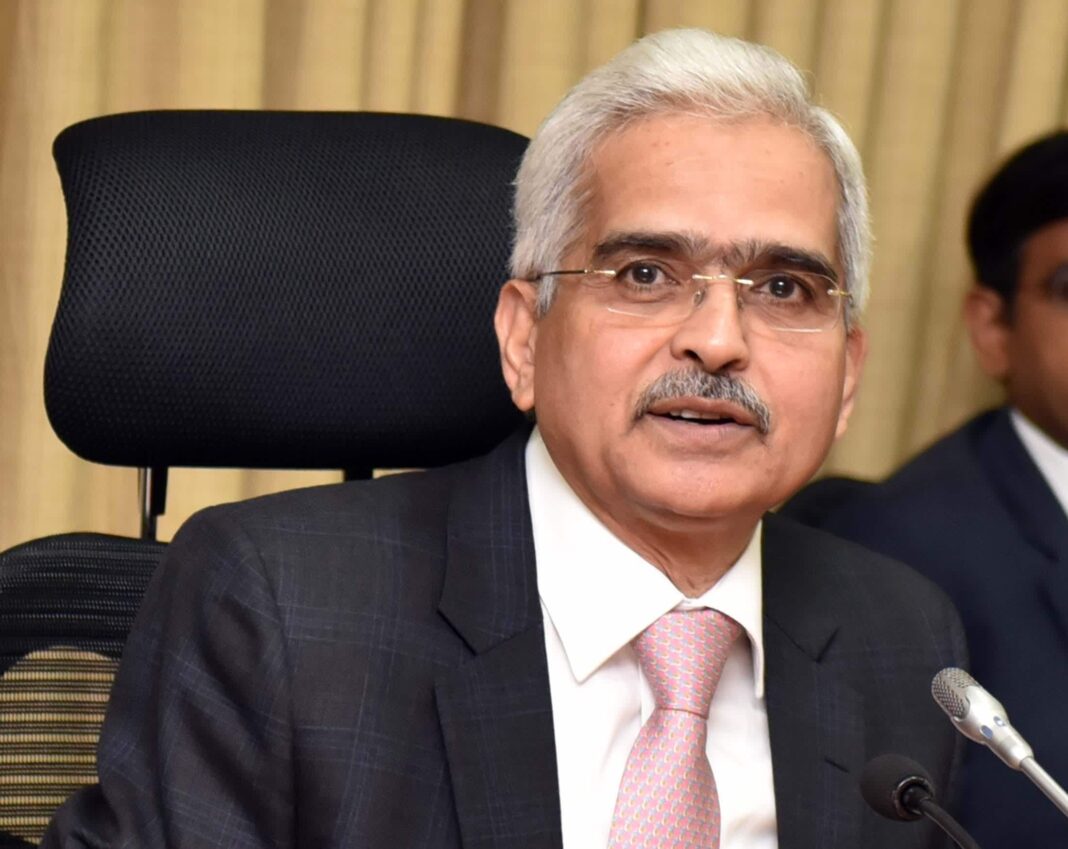

“It’s a pre-sanctioned credit line. That means, a credit line has been sanctioned by the bank and the customer can now operate through UPI,” said Das in a post-monetary policy press meeting.

“With the restrictions which were earlier imposed on disbursements into prepaid wallets and cards from credit-lines and loans, many BNPL players had to resort to tenuous work-arounds to continue to deliver a seamless purchase experience. With the UPI channel opened up for access to credit lines, the point-of-purchase credit experience becomes seamless and opens up avenues to use credit across a much larger merchant base. This has the potential to drive transformational growth for the BNPL lending sector,” he said.

“UPI, which currently involves transactions between deposit accounts or wallets, will now expand further to credit lines given by banks. So, in a sense, one can actually reduce the number of cards they carry and do those transactions on UPI rails,” said T Rabi Sankar, RBI deputy governor.

[ad_2]

Source link