[ad_1]

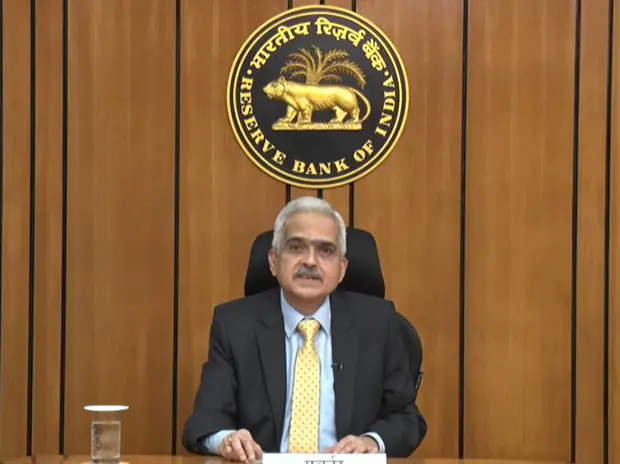

The Reserve Bank of India (RBI) aims to reduce inflation to its medium-term target of 4 per cent in the next two years and its rate actions will be data dependent, said governor Shaktikanta Das on Tuesday.

Consumer Price Index-based inflation—the central bank’s monetary policy anchor—was at 6.71 per cent in July, marking the first time in four months that the price gauge dropped below 7 per cent. “We would like to bring down inflation over a time cycle of about two years or so…By and large, I think we are moving closer to 4 per cent in a steady manner without much of growth sacrifice,” Das said in an interview to television channel ET Now.

The RBI’s Monetary Policy Committee (MPC) is mandated to keep CPI inflation at 4 per cent, with a variation of 2 per cent on either side. The MPC has raised the policy repo rate by a total of 140 basis points since May 4 and it is currently at 5.40 per cent.

According to the RBI’s assessments, inflation has peaked and it is expected to moderate, said Das.

In minutes of the MPC’s August 3-5 meeting released last week, external members Ashima Goyal and Jayanth Varma said that the rate-setting panel’s actions should be driven by incoming data. Tuesday’s TV interview marked the first time in several months that Das himself said that the future trajectory of interest rates would be data driven.

Since the first rate hike on May 4, the MPC has tweaked the wording of its stance. It was accommodative while focusing on the withdrawal of accommodation. The stance was changed to one that is focused on the withdrawal of accommodation. “I will not be able to give forward guidance about our future rate actions. In May we increased the rates by 40 basis points, then 50 (bps) and then 50 (bps)–in three installments we have done it,” Das said.

“Going forward, the incoming data and the way the situation unfolds, as I described, the inflation-growth dynamic, how it plays out, that will determine our future action.”

Das said the government bond yield curve indicated that inflation was coming down. After touching an over-three-year high of 7.62 per cent on June 16, yield on the 10-year benchmark government bond has eased significantly, settling at 7.28 per cent on Tuesday.

“If you look at the 10-year g-sec (government security), the 10-year g-sec before we started the May meeting of the MPC when we started the current rate hike cycle by 40 basis points, just before that it was around 7.1-7.12 per cent and today it’s around 7.28 per cent,” said Das.

Apart from anchoring of inflation expectations, bond yields were driven by easing prices of crude oil and other commodities as well as fluctuations in the US currency.

Current account deficit

The RBI governor said that India’s current account deficit (CAD) would be within manageable levels and financed in a “reasonably comfortable” manner. Economists expect India’s current account deficit to rise to around 3 per cent of GDP this fiscal year, from 1.2 per cent of GDP in the previous financial year.

Das cited the recent decline in crude oil factors as a key factor that would help contain the CAD. “But (on) crude oil prices now, there are many experts internationally who are taking a position that the crude oil price will be below $100 per barrel. This was not in the realm of anybody’s thinking a couple of months ago,” he said.

“There are institutions which are projecting $95 per barrel. We have, in the Reserve Bank, in the MPC, we have assumed $105 as the average price for the current year,” he said.

Another reason for optimism on the CAD was an expected pick-up in petroleum product exports, given that a recent export tax had been adjusted, Das said.

While saying that he hoped that the debate about whether the RBI was “behind the curve” was over, Das warned against any complacence on the part of the central bank, pointing out that inflation was currently well above the comfort zone.

Banks, fintech, crypto

Speaking on the gap between credit and deposit growth, Das said, “If the banks have to achieve a credit growth of 13-15 per cent, they have to resources by way of increasing the deposit rates. And it is beginning to happen.”

As per the latest RBI data, the credit growth in the economy was 14.5 per cent as of July 29. However, deposits grew at 9.1 per cent during the same period.

Commenting on the greater scrutiny by RBI on the fintech sector, Das said, “We are supportive of innovation in fintech but at the same time we have to evaluate what kind of risk build up is happening and whether they are getting addressed or not.”

In its effort to mitigate the concerns arising of credit delivery through digital lending methods, the RBI, earlier this month, came out with guidelines aimed at firming up the regulatory framework over such activities, wherein it has categorically specified that lending business can only be carried out by entities regulated by it or other such competent authorities under the law.

On whether charges should be levied on UPI transactions, the Governor said, “We have come out with a discussion paper. Our idea was to get stakeholder comments so let the comments come, we will examine them and move forward.”

Last week, in a discussion paper, the RBI sought feedback from stakeholders on the possibility of imposing a “tiered” charge on payments made through the UPI, based on different amount bands.

Following this discussion paper, the government denied any intention of levying charges on UPI transactions. The finance ministry said the concerns of the service providers for cost recovery have to be met through other means.

Reiterating his stance on cryptocurrencies, Das said, “I am happy that we sounded those warning signals and anecdotally we are aware that many people did not invest or pulled out of crypto thanks to the caution and concerns that the RBI expressed.”

“Cryptocurrencies can create a lot of financial instability in terms of the ability of the central bank to determine monetary policy. It will also have an adverse impact on our exchange rate, capital flows, and banking sector stability. It can potentially be used for money laundering and illicit transfer of money.”

[ad_2]

Source link