[ad_1]

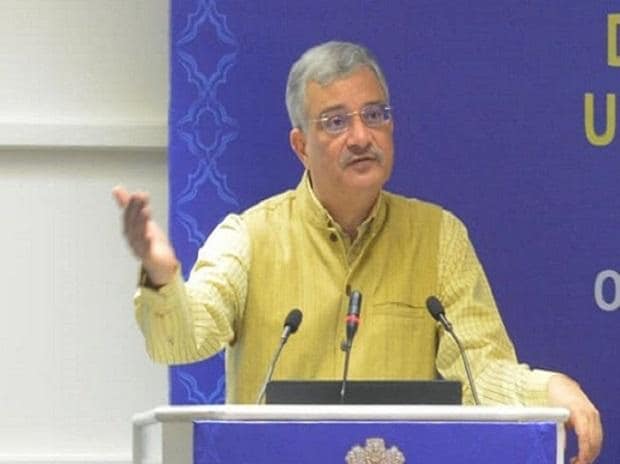

Financial Services Secretary Vivek Joshi on Thursday chaired a meeting with heads of Public Sector Banks (PSBs) and financial institutions, and urged them to push various financial inclusion schemes, including Jan Suraksha and Mudra Yojana.

The day-long review meeting was also attended by senior officials from the Department of Animal Husbandry, Department of Fisheries, Ministry of Housing and Urban Affairs, and Ministry of Agriculture & Farmers Welfare.

Joshi exhorted the PSBs to achieve the targets allocated to them under the various schemes for financial inclusion in a time-bound manner, the finance ministry said in a statement.

To achieve saturation under Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY), the ministry has also launched a three-month campaign.

PMJJBY offers life insurance cover of Rs 2 lakh in case of death due to any reason to people in the age group of 18-50 years having a bank or post office account, who give their consent to join or enable auto-debit of premium.

On the other hand, PMSBY offers insurance cover of Rs 2 lakh for accidental death or total permanent disability and Rs 1 lakh for partial permanent disability to people in the age group of 18-70 years with a bank or post office account, who give their consent to join or enable auto-debit of premium.

Banks have been advised to leverage their banking correspondents network for outreach and enrolling potential beneficiaries, the statement said.

The finance services secretary also requested banks to conduct awareness campaigns about these schemes in regional or vernacular languages.

In a bid to give a push to micro insurance schemes, the Secretary had a meeting with chief secretaries and senior officials of all states and union territories and officials from 10 central ministries and departments, including those from labour and employment, housing and urban affairs, agriculture and farmers welfare, and rural development earlier this week.

The meeting, also attended by Chairman NABARD and CEO of NPCI, reviewed the progress of StandUp India and PM SVANidhi Schemes.

In order to promote entrepreneurship at the grass-root level, banks have sanctioned more than Rs 40,700 crore to over 1.80 lakh beneficiaries under StandUp India Scheme in seven years.

StandUp India Scheme, launched on April 5, 2016, with a focus on economic empowerment and job creation, has been extended up to 2025.

The scheme aims to encourage all bank branches in extending loans to borrowers belonging to SC, ST and women borrowers in setting up their own greenfield enterprises.

Last year, the government approved the continuation of the Prime Minister Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) Scheme till December 2024.

The PM SVANidhi Scheme was launched in June 2020 by the government as a micro-credit facility with an aim to empower street vendors to recover losses incurred as a result of the Covid-19 pandemic.

Through PM SVANidhi, affordable collateral-free loans are given to street vendors.

The progress of Kisan Credit Cards (KCC) scheme was also discussed in the meeting with special focus on issuance of KCC for animal husbandry and fisheries, the statement said.

Scaling up of the account aggregator ecosystem was also reviewed. Issues related to Debt Recovery Tribunal (DRT) and digital document execution framework were also discussed in the meeting, it added.

[ad_2]

Source link