[ad_1]

The Union Cabinet chaired by Prime Minister Narendra Modi on Wednesday doubled the allocation for promotion of RuPay debit cards and low-value BHIM-UPI (Unified Payments Interface) transactions to Rs 2,600 crore for FY23 that aims at promoting digital payments across the country.

The scheme was first announced in FY22 Budget with a financial outlay of Rs 1,300 crore.

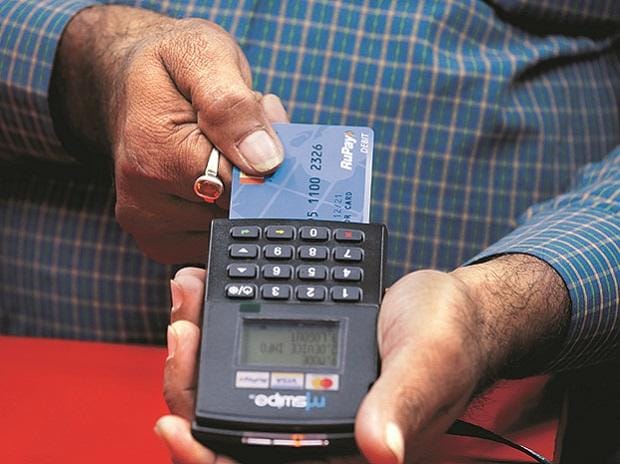

“Under the said scheme, acquiring banks will be provided financial incentive for promoting point-of-sale (PoS) and e-commerce transactions using RuPay debit cards and low-value BHIM-UPI transactions (person-to-merchant) for the current financial year,” said Ministry of Electronics & IT in a statement.

This is part of the Centre’s initiatives to promote digital payments across the country. During the pandemic, digital payments facilitated the functioning of businesses, including small merchants, and helped maintain social distancing. UPI achieved a record of 78.29 million digital payment transactions with a value of ₹12.82 trillion in December 2022.

“Various stakeholders in the digital payments systems and the Reserve Bank of India (RBI) (had) expressed concerns regarding the potential adverse impact of the zero MDR regime on the growth of the digital payments ecosystem. Further, the National Payments Corporation of India (NPCI) requested, among other things, for incentivisation of BHIM-UPI and RuPay Debit Card transactions to create a cost-effective value proposition for ecosystem stakeholders, increase merchant acceptance footprints and faster migration from cash payments to digital payments,” the statement said.

The government had made the MDR for RuPay debit cards (and UPI) zero, effective January 1, 2020. MDR is the rate charged to a merchant for payment processing services on various payment instruments.

Total digital payment transactions registered a year-on-year growth of 59 per cent, rising from Rs 5,554 crore in FY 2020-21 to Rs 8,840 crore in FY 2021-22. BHIM-UPI transactions registered a year-on-year growth of 106 per cent, rising from Rs 2,233 crore in FY 2020-21 to Rs 4,597 crore in FY 2021-22.

In August last year, the RBI sought a feedback from stakeholders on the possibility of imposing a “tiered” charge on payments through the UPI, based on different amount bands. It also asked whether RuPay cards can be treated differently from other debit cards affiliated to international card networks in terms of MDR.

[ad_2]

Source link