[ad_1]

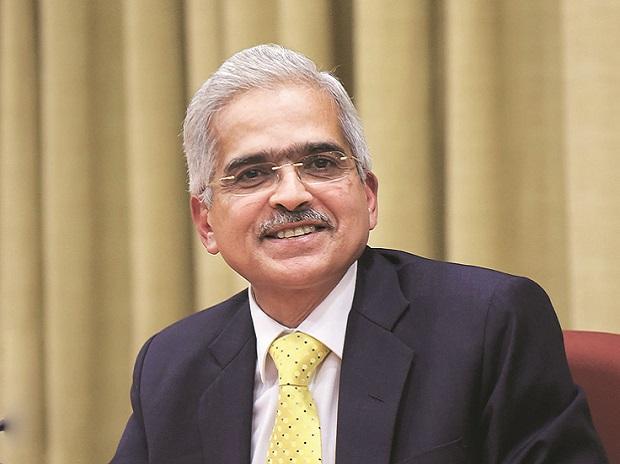

The wide gap between credit and deposit growth is because of their respective bases and both reflect the fundamentals of the Indian economy, Reserve Bank of India’s governor Shaktikanta Das said at the Business Standard BFSI Insight Summit on Wednesday.

“Just as credit growth looks very high because of the low base of the previous year, deposit growth also looks pretty low because of the base effect of the previous years. This is because in the Covid period, deposits were growing by around 10 or 11 per cent,” Das said during a fireside chat.

According to latest data released by RBI, bank credit is growing at 17.5 per cent while deposit growth is lagging at 9.9 per cent, as on December 2, 2022. Credit growth during the year-ago period was 7,3 per cent and deposits were growing at 9.4 per cent.

“The December 2 figures are the latest, (and) I was looking at the numbers – from November 2021-end till December 2, 2022, credit growth in absolute numbers is Rs 19 trillion, and deposit growth is Rs 17.4 trillion. So it isn’t as if there is a big gap between the deposit growth and the credit growth. The base effect of both is making it look that much more divergent,” he said, adding that the growth numbers are reflective of the underlying fundamentals of the economy, apart from the pent-up demand for credit during the past two years.

“So considering all these factors, I think the credit growth at the current point is certainly far, far away from what you call exuberance,” he said.

He said the weighted average lending rate on fresh loans has risen by about 117 basis points, while the weighted average deposit rates have gone up by 150 bps.

“Therefore deposit rates are picking up, and going forward it’s a function of the markets. Both lending rates and deposit rates are a function of the market and a function of the Reserve Bank’s policy rate; so I think deposit rates are picking up and they may even go up a little bit more,” he said.

Das said also said the polls will not determine monetary policy when asked whether there would be any challenges on announcements.

General elections in the country are due in mid 2024. Next year’s Union Budget will be the last full budget before the polls. Governments tend to present populist budgets before an election, which can be challenging when inflation is still sticky and close to the upper tolerance zone of the central bank.

“…the fact is that there is an election – because in India an election happens every year, and there is a combination of states also undergoing elections. So, election is not a concern so far as monetary policymaking is concerned. Monetary policy will do whatever is in the best interests of the economy,” Das said, adding the government is equally serious on controlling inflation.

The monetary policy of the RBI has increased the policy repo rate by 225 bps to 6.25 per cent since this May. The central shifted its focus on controlling inflation from supporting growth since the war in Europe broke out. The conflict had led to supply side bottlenecks which stoked inflation in many countries, including India.

[ad_2]

Source link