[ad_1]

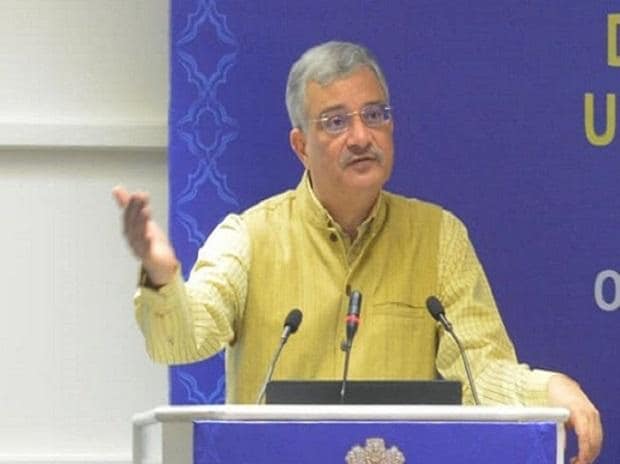

Banks and financial institutions need to design products in sync with requirements of infra projects in view of the whopping Rs 111 lakh crore National Infrastructure Pipeline (NIP), Financial Services Secretary Vivek Joshi said on Thursday.

Observing that the infrastructure sector has strong backward and forward linkages with the robust multiplier effect across the sectors, he said, NIP along with other initiatives like Make in India, Production-Linked Incentive scheme is poised to catapult India to a USD 5 trillion economy.

Under the aegis of PM Gatishakti portal, he said, NIP projects with a total outlay of Rs 111 lakh crore are being monitored. The NIP, which started with 6,800 projects, has now expanded to over 9,000 projects covering 34 infrastructure sub-sectors.

While 44 per cent of investment is funded through the central and state budgets, banks, financial institutions and Development Finance Institutions (DFIs) are expected to play a crucial role in financing of these projects with a share of about 30 per cent, he said while addressing an event marking the 18th foundation day of state-owned IIFCL here.

“To achieve this objective there is a need for proactive and synergetic approach to be adopted by banks, FIs and the DFI. It is only then that the crowding out of investments can be avoided and projects of national importance will be able to access timely and reasonable financing,” he said.

The government in 2021 set up National Bank for Financing Infrastructure and Development (NaBFID) as a DFI with a view to supporting the development of long-term non-recourse infrastructure financing in India, including development of the bonds and derivatives markets necessary for infrastructure financing and to carry on the business of financing infrastructure.

The government has committed a Rs 5,000-crore grant over and above the Rs 20,000-crore equity capital for NaBFID.

For public institutions operating in this space, Joshi said, it is important to offer a mix of equity and debt products on alternative term without impacting each other’s efforts to expand business.

“Meeting financing needs of new infrastructure with products which are in sync with project reality is need of the hour. Institutional capacity to serve projects across current and emerging sub-sectors should be constantly evaluated. Here institutions like IIFCL can play a leading role,” he said.

Quoting a World Bank report, Joshi said, it has upped it GDP forecast from 6.5 per cent to 6.9 per cent for current financial year suggesting the country is showing greater resilience to the global shocks.

During the first half of current financial year, India clocked a GDP growth of 6.3 per cent.

With regard to inflation, Joshi said, it is showing signs of moderation as evident by the latest figures.

The wholesale price-based inflation fell to a 21-month low of 8.39 per cent while retail inflation moderated to an 11-month low of 5.8 per cent in November.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

[ad_2]

Source link