[ad_1]

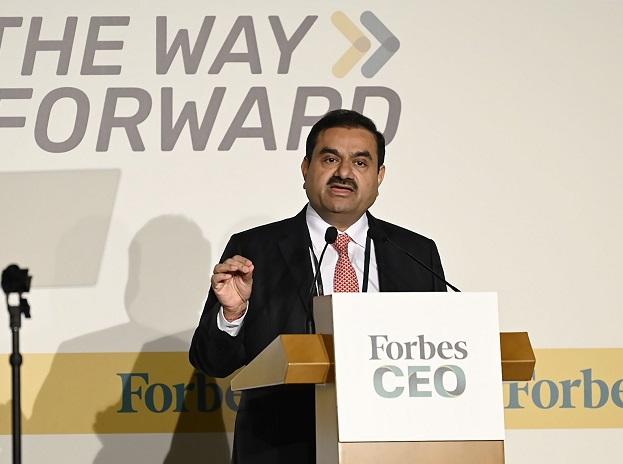

Asia’s richest man Gautam Adani said credit metrics at his businesses are improving and a deeper understanding of his rapidly expanding conglomerate would allay any concerns around its borrowings.

“Greatly surprised by the conversations about our debt,” Adani said in an interview with local news channel India Today late Wednesday. “In the past nine years, our profit has been growing at twice the rate of our debt.”

Asserting that the ports-to-power conglomerate is “financially very strong and secure,” the Indian billionaire said that the strong profit trajectory had helped pare the Debt-to-Ebitda ratio to 3.2 from 7.6 in the same time period. That “is very healthy for a large group where most of the companies are in the infrastructure space.”

The first-generation entrepreneur — also the world’s biggest wealth gainer in 2022 — has been on a breakneck expansion spree that includes seeding new businesses as well as a spate of acquisitions. Adani is rapidly diversifying his empire beyond ports and coal-based businesses into green energy, airports, cement, media, data centers and metals. A lot of this growth has been debt-fueled, which has been red-flagged by some credit watchers.

The tycoon also said that his companies now have a broader lender mix. The share of loans from Indian banks has reduced from 86 per cent to 32 per cent in the overall debt portfolio in the past nine years. “Almost 50% of our borrowing is through international bonds,” he said.

Adani, who has often dovetailed his corporate strategy to federal government’s nation-building priorities, is also very bullish on India’s prospects. “This century belongs to India,” he said, elaborating that the country will add a trillion dollars to its GDP every 12 to 18 months within the next decade given its large middle class and young population.

Some of his other comments from the interview:

-

India will emerge as a green hydrogen exporter as the government’s production-linked incentive plan makes the business viable and attractive. -

The next budget is a great opportunity to address concerns about the global recession. -

A strong focus on capital expenditure, employment, spending on social infrastructure and social security will help India in facing global headwinds -

New Delhi Television Ltd., his latest acquisition in the media sector, would remain editorially independent. “NDTV will be a credible, independent global network,” Adani said. -

Role across business is limited to “formulating strategy, capital allocation and their review,” giving the tycoon time incubate new businesses and look for acquisitions

[ad_2]

Source link